In a recent Women In Optometry Pop-up Poll, respondents shared their strategies for paying down their student loan debts. An earlier WO poll showed that 96 percent of ODs say that they graduated with student loan debt; 34 percent of the respondents said their student debt load is or was more than $200,000.

Forty-two percent of respondents who are carrying student loan debt said that they are paying of their monthly balances plus additional principle every month. Another 20 percent say they pay down on the principle in addition to the monthly balance when they can. However, more than one-third of respondents (34 percent) say they are paying off monthly balances alone. Another five percent noted that they’re seeking or currently in deferment or using an income-based repayment plan.

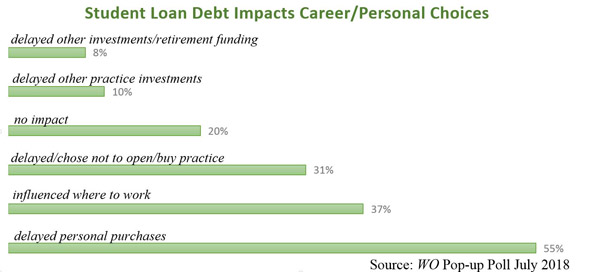

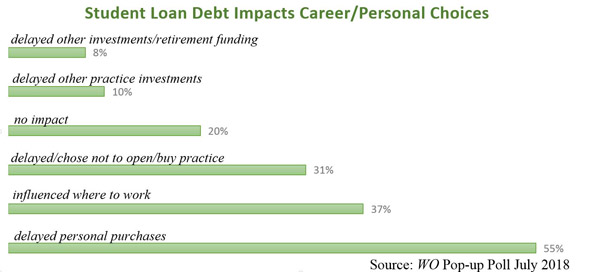

Overall, about one-in-five ODs said that their debt load has no impact on the career choices they’re making. However, more than half of the ODs who responded said that it has impacted career and personal decisions.

- 55 percent of respondents say their debt load has delayed making larger personal purchases, such as a car or home.

- 37 percent said that their debt has affected where they have chosen to work.

- 31 percent said that they’ve delayed or chosen not to open or buy into a practice because of their debt load.

- One recent grad noted that her student debt actually convinced her to go into practice for herself sooner.

- Smaller percentages of ODs said that they’ve delayed equipment purchases or other investments in their optometric practice or other business ventures, and several noted that they delayed making or maximizing contributions to retirement plans or other investments.

The majority of respondents to this poll were employed ODs (63 percent), and the next largest category (25 percent) said that they are owners or co-owners of their practices. Eighty-five percent of the respondents are women ODs and 15 percent were male ODs, according to the poll results.

Women In Optometry will be looking at student loan debt in more detail in our next issue. If you have a story to tell about how you opened a practice while carrying student loan debt, how your debt has limited you or how you’re managing your debt load, please email mbijlefeld@jobson.com.