2024 Pharma IssueIn the March issue of Review of Optometry, experts provide exciting updates on incoming treatments and prescribing protocols. Check out the other article featured in this issue:

|

Last year was a standout in the advancement of medical treatment of eye disease, as we clinicians and our patients dually benefited from a wealth of new FDA drug approvals. From presbyopia to glaucoma to dry eye and much more, we gained an even greater arsenal of tools to improve the lives of our patients. This influx of innovative therapies not only marks a pivotal moment in the evolution of eye care but also reinforces the commitment to elevating patient outcomes through the continuous pursuit of excellence in the field.

This comprehensive review aims to help every eye doctor be knowledgeable about new medications in the field so that we may offer up-to-date and effective treatments and build patient trust through evidence-based care practices.

Note that most of the product details and efficacy claims described below come from the manufacturers themselves and have not always been independently verified.

Pupil Mechanics

From presbyopes hoping for lens-free clarity of vision to ODs performing clinical dilation in an office setting, manipulation of the pupil is being addressed with multiple new drugs. Described below are the current two presbyopia drops on the market and two recently approved drops for pupil dilation and reversal, plus a glimpse of some upcoming agents.

Presbyopia drugs. Early disenchantment with medical therapy for presbyopia prompted development of longer-acting agents and more patient-friendly regimens, two of which are now available, one wholly new to the market and the other a retooling of the original presbyopia drop:

- Qlosi (pilocarpine hydrochloride 0.4%), Orasis Pharmaceuticals

- Status: FDA-approved October 2023.

- Preservatives: Preservative-free.

- Mechanism of action: Cholinergic muscarinic agonist that activates receptors on the smooth muscles of the iris sphincter and ciliary muscle. This stimulates contraction, constricts the pupil and leads to miosis, enhanced depth of focus and improved near vision.

- Clinical trial data: NEAR-1 and NEAR-2 found statistically significant three-line or more gain in distance-corrected near visual acuity.

- SIG: Topical ophthalmic drop dosed QD-BID.

- Side effects: Headaches (6.8%), instillation site pain (5.8%), blurred vision and ocular discomfort.

- What’s exciting? This is a preservative-free formulation, and its low concentration maintains some pupillary response to light.

- Vuity (pilocarpine hydrochloride 1.25%), AbbVie

- Status: The original 2021 formulation received an updated FDA approval for BID dosing in March 2023.

- Preservatives: Benzalkonium chloride 0.0075%.

- Mechanism of action: Cholinergic muscarinic agonist that activates receptors on the smooth muscles of the iris sphincter and ciliary muscle. This stimulates contraction, constricts the pupil and leads to miosis, enhanced depth of focus and improved near vision. Ciliary muscle contraction may shift the eye to a more myopic state.

- Clinical trial data: VIRGO (BID); 230 patients in 14-day trial receiving BID dosing six hours apart. Clinically significant portion of participants gained three lines or more in mesopic, high contrast, binocular distance corrected near VA without losing more than one line of corrected DVA.

- SIG: Topical ophthalmic drops dosed QD-BID; second dose may be administered three to six hours after first dose.

- Side effects: In Phase III GEMINI I and II trials, 14% reported headaches (typically mild) being most notable. There have also been rare reports of retinal detachments after use of Vuity, which was not a side effect reported in clinical trials (n=750 patients in Phase III trials).

- What’s exciting? Now able to use twice daily for longer effect.

There are several other presbyopia medications in the pipeline, with interesting new approaches to instillation and mechanism of action. Below are the likely next two to come:

-

MicroLine (pilocarpine hydrochloride 2% with Optejet microdose dispenser), Eyenovia

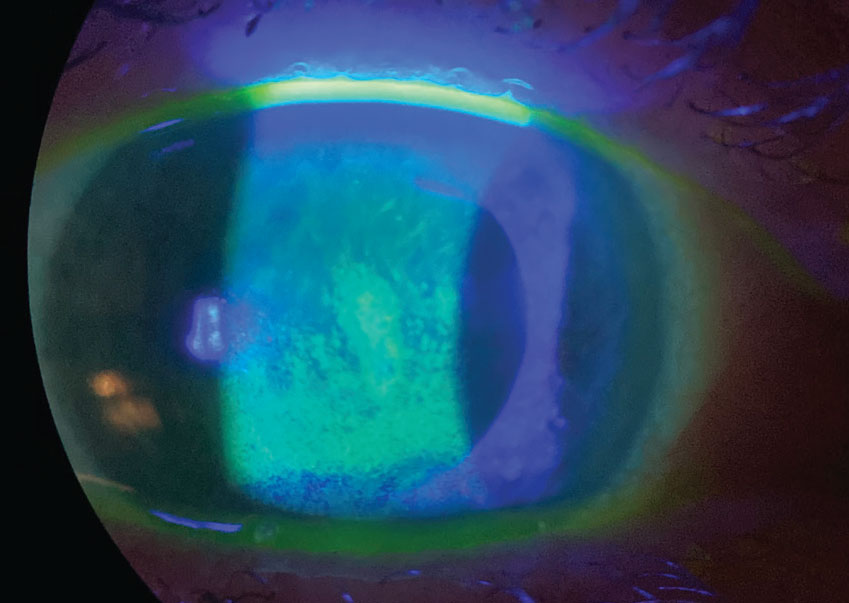

New drugs Mydcombi and Ryzumvi can be used to return dilated pupils to baseline more quickly. Photo: Ellen M. Petrilla, OD. Click image to enlarge.

- Status: Phase III (Vision-1).

- Mechanism of action: Non-selective alpha-1/2 adrenergic antagonist that inhibits the contraction of smooth muscles within the iris dilator muscle, causing a decrease in pupillary diameter.

- What’s exciting? Its “microdose” dispenser releases far less medication to the eye than a conventional drop.

- Nyxol (phentolamine 0.75%), Ocuphire Pharma

- Status: Phase III (VEGA-2).

- Mechanism of action: Non-selective alpha-1/2 adrenergic antagonist that acts on the adrenergic nervous system and inhibits smooth muscle contraction in the iris, causing a decrease in pupillary diameter.

- What’s exciting? Doesn’t engage the ciliary muscle, so no risk of retinal complications. Aiming to receive indication for both presbyopia as well as dim light or night vision disturbances. Durable effect of pupil reduction (up to 24 hoursr), so QPM dosing effective. Only side effects are transient red eye and instillation discomfort.

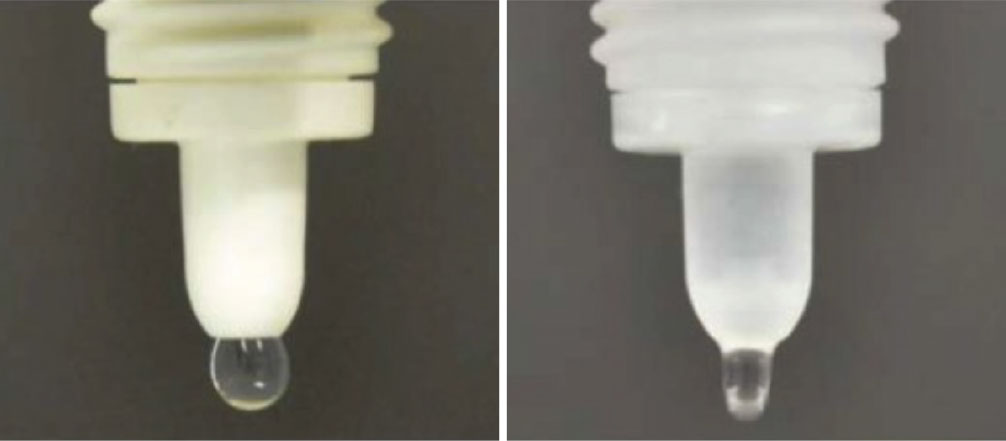

Clinical dilation and reversal agents. Despite the popularity and impressive imaging capabilities of ultra-widefield retinal cameras, there’s no substitute for a dilated exam of the fundus. Two recent drug approvals aim to make that experience more patient friendly by hastening the return to baseline pupil size:

- Mydcombi (tropicamide 1% + phenylepherine 2.5%), Eyenovia

- Status: FDA-approved May 2023 for mydriasis.

- Preservatives: None.

- Mechanism of action: Induces mydriasis and cycloplegia for diagnostic purposes.

- Clinical trial data: Approximately 94% of treated eyes achieved >6mm pupil dilation 35 minutes after instillation with <1% reporting stinging.

- SIG: Topical ophthalmic spray, administered as needed for diagnostic purposes.

- Side effects: Mild stinging resolving quickly, blurred vision.

- What’s exciting? Uses the company’s Optejet formulation, instilling the drop as a spray within 80 milliseconds (faster than the blink reflex) and delivering 80% less medication (around 8µL).

- Ryzumvi (phentolamine 0.75%), Ocuphire (see previous discussion on Nyxol, the same active ingredient under research for presbyopia therapy)

- Status: FDA-approved September 2023 for reversal of pharmacologically induced mydriasis.

- Preservatives: Preservative-free.

- Mechanism of action: Non-selective alpha adrenergic agonist that inhibits contractions of smooth muscles (works directly on the radial muscles, indirectly on sphincter muslces) without affecting ciliary muscle.

- Clinical trial data: Percentage of eyes returning to within 0.2mm of baseline pupil size was greater at all time points from one hour to 24 hours in Ryzumvi group compared to placebo. Maximal effect in 60 to 90 minutes.

- SIG: One to two drops as needed after ophthalmic exam in which pupils were pharmacologically dilated. If two drops administered, wait five minutes between.

- Side effects: 16% stinging, 12% hyperemia.

- What’s exciting? Pupil returns to baseline in 60 to 90 minutes. This is the first time in decades that clinicians have a dilation reversal drop available.

Myopia Treatments

Management of refractive error has come a long way from just addressing kids’ visual acuity demands with a pair of glasses. With many newer myopia management interventions available, atropine is the primary pharmaceutical option. While this agent is being used off-label today, a few companies are nearing the end of the development pipeline, making FDA-approved atropine a real possibility in 2024 or 2025.

|

|

While atropine is currently used off-label as a myopia control agent, FDA approval is likely coming for as many as three drugs. Photo: Getty Images. Click image to enlarge. |

- NVK002 (0.01% & 0.02% atropine), Vyluma

- Status: Phase III (CHAMP). Its PDUFA date of January 31, 2024 came and went without FDA action. No further details available at press time.

- Mechanism of action: Interestingly, the desired MOA is not related to antimuscarinic effects on the iris sphincter muscles and ciliary body (which in this case would be undesired side effects). The exact MOA is still unknown, but it is thought to be related to modulation of dopamine release, which has been correlated with the rate of growth of axial length.1

- What’s exciting? Preservative-free drop with QPM dosing.

- MicroPine (atropine microdose), Eyenovia

- Status: Phase III (CHAPERONE), PDUFA date March 2024.

- Mechanism of action: See above.

- What’s exciting? Optejet dispenser delivers a 8µL mist horizontally onto the eye (vs. a typical 40µL drop).

- SYD-101 (0.01% and/or 0.03% atropine), Sydnexis

- Status: Phase III (STAR), data anticipated this June.

- Mechanism of action: See above.

- What’s exciting? Includes a stabilizing agent. Traditionally, atropine is very unstable, so its pH is lowered (pH<5) to stabilize it; however, this decreases bioavailability and also leads to its notorious stinging side effect. SYD-101 aims to maintain pH at a comfortable level without loss of efficacy.

Dry Eye and Ocular Surface Treatments

It’s an exciting time for this condition, as some truly innovative drugs have recently entered the market. New avenues for intervention are being explored for the first time with pharmacologic agents, including treatments for meibomian gland dysfunction (MGD) and Demodex blepharitis, both of which may contribute to ocular surface irritation. Let’s look at those two first:

-

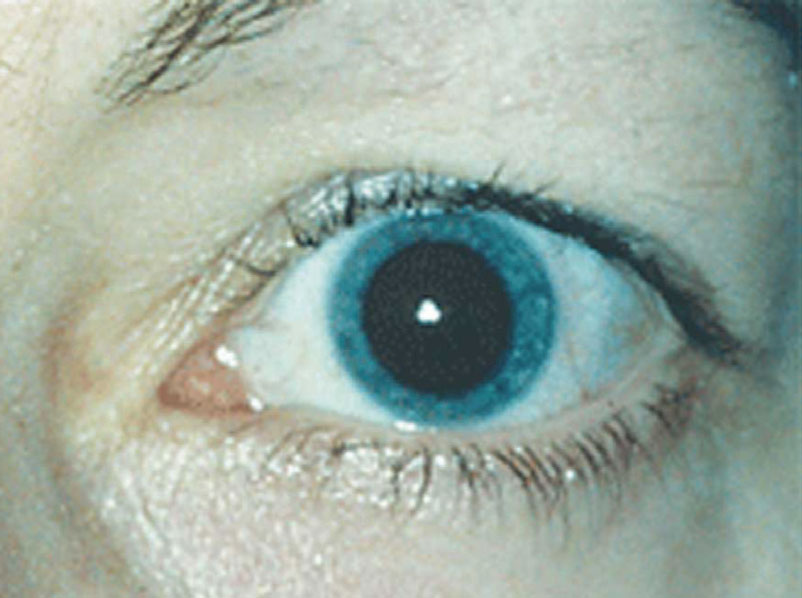

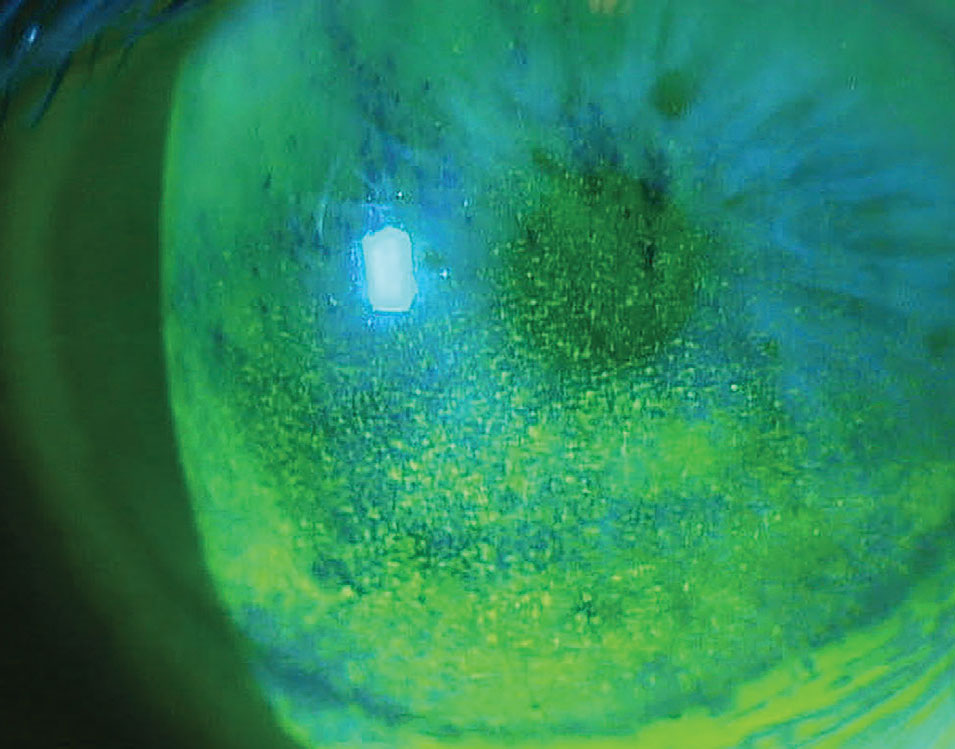

Xdemvy (lotilaner 0.25%), Tarsus Pharmaceuticals

Collarettes are pathognomonic for Demodex blephariris. Xdemvy should help eliminate the mites by reducing the population in and around the meibomian glands. Photo: Pam Theriot, OD, and Lisa Hornick, OD. Click image to enlarge.

- Status: FDA-approved July 2023 for Demodex blepharitis.

- Preservatives: Potassium sorbate.

- Mechanism of action: Anti-parasitic, lipophilic drop that acts via mite GABA-gated chloride channels to target, paralyze and kill Demodex.

- Clinical trial data: Saturn 2 study: 60% total eradication of mites, 50% reduction of collarettes. Now has longitudinal data from Saturn 1 study out to six months and one year time points. Complete collarette cure vs. control was 39.8% vs. 2.7%, respectively, at six months and 23.5% vs. 2.9% at one year. The proportion of subjects with 10 or fewer collarettes (grade 0 or 1) was also significantly higher in study group than in control at 70.3% vs. 18.0% at six months and 62.6% vs. 21.9% at one year. Erythema cure (grade 0) was 21.1% in study group vs. 6.3% for controls at six months and actually improved at one year 28.7% in study group vs. 14.3% in control group.

- SIG: BID dosing for six weeks.

- Side effects: Stinging and burning (10%), chalazion/hordeolum (<2%), punctate keratitis (<2%).

- What’s exciting? This is the first FDA-approved medication for the treatment of Demodex blepharitis. Treatment entails a six-week regimen.

- Miebo (100% perfluorohexyloctane), Bausch + Lomb/Novaliq

- Status: FDA-approved May 2023 to treat signs and symptoms of dry eye disease associated with MGD.

- Preservatives: None.

- Mechanism of action: Exact mechanism unknown. Creates monolayer at air-liquid interface of tear film, reducing evaporation.

- Clinical trial data: GOBI and MOJAVE met primary signs and symptoms endpoints of total corneal fluorescein staining and eye dryness via Visual Analog Scale score. Symptomatic relief as early as day 15.

- SIG: Topical ophthalmic drop QID dosing.

- Side effects: Blurred vision, conjunctival redness in 1% to 3% of patients.

- What’s exciting? Its non-aqueous liquid formulation precludes microbial growth potential, so a preservative is not necessary. The agent is also non-blurring.

|

|

Severe obstructive MGD can exacerbate dry eye signs and symptoms. The new drug Miebo is approved to help with signs and symptoms associated with this |

Again, each of the above address MGD-mediated ocular surface conditions in wholly new ways: Xdemvy by reducing the Demodex population in and around meibomian glands, and Miebo by stabilizing the tear film in a way that mimics the natural lipid layer’s role. But we also now have the chance to consider a new formulation of dry eye treatment mainstay, cyclosporine:

- Vevye (0.1% cyclosporine), Harrow

- Status: FDA-approved June 2023 for treatment of dry eye disease.

- Preservatives: None.

- Mechanism of action: A calcineurin inhibitor that exerts immunomodulatory effects. This is achieved through blocking T-cell infiltration, activation and the subsequent release of inflammatory cytokines.

- Clinical trial data: Up to 71.6% of patients responded within four weeks with a clinically meaningful improvement of ≥3 grades in total corneal staining.

- SIG: BID.

- Side effects: Eye irritation (8%) and temporary blurred vision (3%).

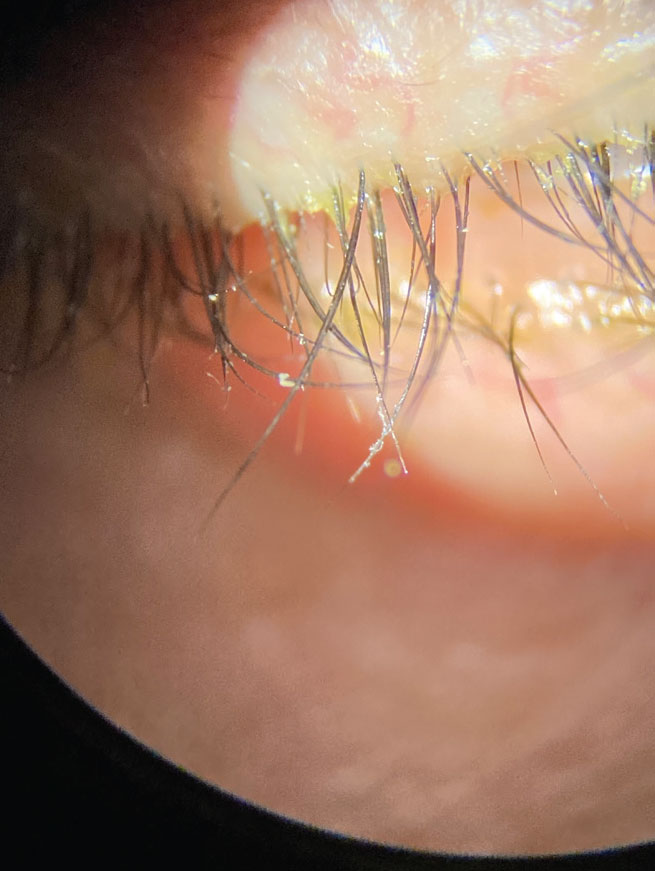

- What’s exciting? Another cyclosporine may not sound exciting, but the vehicle, EyeSol, is a water-free base that uses inert semifluorinated alkanes. By having low surface and interface tension, the drops can spread rapidly over the ocular surface and form a flat, transparent layer that could allow for improved visual clarity—without potential blurring. All lead to higher bioavailability, faster efficacy and higher patient satisfaction.

Running up behind these new players are many just out of reach, but which will likely be available very soon:

- APP13007 (clobetasol propionate 0.05%), Eyenovia

- Status: NDA May 2023, PDUFA date March 2024 for inflammation and pain treatment after cataract surgery.

- Mechanism of action: Activation of either glucocorticoid receptor or the mineralocorticoid receptor in target tissues to cause anti-inflammatory effects.

- What’s exciting? Stronger steroid compared to others on the market for postoperative pain and inflammation; BID dosing.

-

AR-15512, Aerie Pharmaceuticals

The vehicle in the Vevye drop, called EyeSol, uses inert semifluorinated alkanes to spread rapidly over the ocular surface, forming a flat, transparent layer. This is due to it possessing low surface and interface tension. Click image to enlarge.

- Status: Phase III (COMET-3).

- Mechanism of action: TRPM8 receptors are cold-sensitive thermoreceptors that play a key role in tear film homeostasis. AR-15512 is a potent and highly selective TRPM8 agonist. This product stimulates tear production and produces a cooling sensation.

- What’s exciting? A new therapeutic for dry eye and potentially neuropathic keratitis, given its agonistic effect on TRPM8 receptors.

- OCS-1 (dexamethasone 15mg/mL), Oculis

- Status: Phase III (OPTIMIZE).

- Mechanism of action: Activation of either glucocorticoid receptor or the mineralocorticoid receptor in target tissues to cause anti-inflammatory effects.

- What’s exciting? QD, preservative-free topical steroid for pain and inflammation following ocular surgery.

- Reproxalap (0.25%), Aldeyra

- Status: Phase III (INVIGORATE-2/Tranquility-2). The initial NDA submission of November 2023 was not approved because the “the NDA did not demonstrate efficacy for the treatment of ocular symptoms associated with dry eye,” according to the release. The current plan is to resubmit an NDA for approval to the FDA this year with more positive clinical data.

- Mechanism of action: Reactive aldehyde species (RASP) inhibitor. RASP refers to a class of electrophilic organic aldehyde molecules that facilitate inflammation.

- Clinical trial data: A Phase III trial also met its primary endpoint and was significantly superior for its two pre-specified endpoints: Schirmer’s test (p=0.0001) and ≥10mm Schirmer test responder proportions (p<0.0001) after a single day of dosing.

- What’s exciting? A new anti-inflammatory mechanism of action! Positive implications for a number of inflammatory ocular conditions, most notably looking to get label indication for dry eye syndrome and allergic conjunctivitis.

-

AZR-MD-001 (selenium sulfide ointment), Azura Pharma

Sodium fluorescein staining reveals a compromised corneal surface due to dry eye. The new Vevye cyclosporine drop should help patients with this condition through improving visual clarity but without the potential for blurring to occur. Photo: Pam Theriot, OD, and Lisa Hornick, OD. Click image to enlarge.

- Status: Phase II.

- Mechanism of action: Keratostatic/decrease meibomian gland hyperkeratinization of ducts and orifices, keratolytic/loosen meibomian gland blockages, lipogenesis/increase secretion of meibomian gland lipids.

- What’s exciting? Twice weekly nightly treatment that met co-primary endpoints: improvement of meibomian gland yielding liquid secretions and improved Ocular Surface Disease Index scores.

Keratoconus Drops

Corneal collagen crosslinking has improved many patients’ visual prognoses since FDA approval in 2016. Now, a new drop may offer similar results without the surgery, but is still in the process of being studied.

- IVMED-80 (copper sulfate), Glaukos

- Status: Phase III (Study); FDA orphan drug designation for treatment of keratoconus.

- Mechanism of action: Copper sulfate is a necessary cofactor for lysyl oxidase, an important enzyme for extracellular matrix epistasis. This causes the formation of crosslinks between extracellular proteins leading to reduction in corneal curvature.

- What’s exciting? As it’s an eye drop, this would be the first non-surgical, non-laser treatment for crosslinking of the cornea.

|

|

One eye drop in the later stages of clinical trials might be able to mimic the effects corneal collagen crosslinking surgery. Click image to enlarge. |

Glaucoma

In a crowded corner of the ophthalmic market, three new drugs have recently been FDA-approved. However, each has at least one attribute that distinguishes it from other glaucoma therapies: one delivers the therapeutic agent through an injectable device while two new eye drops have advantages in preservative status and mechanism of action.

- Omlonti (omidenepag isopropyl 0.002%), Visiox

- Status: FDA-approved September 2022, launch early 2024.

- Preservatives: 0.005% benzalkonium chloride.

- Mechanism of action: Relatively selective prostaglandin EP2 receptor agonist, which increases aqueous humor drainage through the conventional (or trabecular) and uveoscleral outflow pathways, and the only product with this pharmacological action.

- Clinical trial data: Lower mean diurnal IOP by 3.7mm to 7.4mm Hg (20% to 30%) from baseline.2

- SIG: 1gtt qHS.

- Side effects: Notably, contraindicated for pseudophakic and aphakic patients due to incidence of cystoid macular edema of nearly 50%.

- What’s exciting? A new-to-market selective prostaglandin EP2 agonist. Perhaps more effective than latanoprost, although no head-to-head studies.

- Iyuzeh (0.005% latanoprost), Thea Pharma

- Status: FDA-approved Dec 2022 for treatment of POAG and OHT.

- Mechanism of action: Prostaglandin F2α analog increasing aqueous humor drainage through trabecular and uveoscleral pathways.

- Preservatives: None.

- What’s exciting? First and only commercially available preservative-free latanoprost, a clear advantage for patients on chronic therapy.

-

iDose TR (travoprost 75mcg intracameral implant), Glaukos

Often, glaucoma medications can cause unwanted ocular surface side effects. Both Iyuzeh and iDose TR are intended to minimize this risk, as neither contain preservatives. Photo: Paul M. Karpecki, OD. Click image to enlarge.

- Status: FDA-approved December 2023 for POAG and OHT. Launch expected Q1 2024.

- Preservatives: None.

- Mechanism of action: An intracameral implant, or canister, inserted into the trabecular meshwork, which slowly elutes travoprost for at least one year.

- Clinical trial data: Both Phase III trials successfully achieved the pre-specified primary efficacy endpoints through three months and demonstrated a favorable tolerability and safety profile through 12 months. IOP reductions from baseline over the first three months were 6.6mm to 8.4mm Hg in the iDose TR arm vs. 6.5mm to 7.7mm Hg in the timolol control arm. In addition, 93% of iDose TR participants remained well-controlled (vs. 67% of timolol control participants) in both studies.

- Side effects: Conjunctival hyperemia occurred at a low rate (3%), while the most frequent adverse event for this dosage was mild transient iritis (rate of 6% for both trials). No corneal or periorbital fat atrophy adverse events were noted, nor was any corneal endothelial cell loss.

- What’s exciting? A new, minimally-invasive surgery technique to treat open-angle glaucoma with a well-established medication but without the concern for topical ocular side effects (dry eye, blepharitis, periorbital fat atrophy).

There is one other glaucoma drug not yet approved but in the development process:

- PDP-716 (brimonidine 0.35%), Visiox Pharma

- Status: NDA accepted December 2022 with an original PDUFA date of August 2023. The company states that it expects to launch in early 2025.

- Preservatives: Not listed.

- SIG: QD.

- What’s exciting? First QD-dosed brimonidine, made possible by a new drug delivery platform the company calls TearAct. The drop is a suspension in which fine resin particles adsorb the active agent; then, these bonds are broken from the shearing force of the blink, prolonging the release of drug by reducing the immediate exposure and providing a slow, consistent and sustained exposure.

Drugs for Rare Posterior Segment DiseasesThe world of retinal drug development is one of the most active areas for ophthalmic research. Anyone who follows this category of biotech news will be accustomed to reading reports of promising new agents and dashed hopes in equal measure. What may one day come to market is anyone’s guess, but the agents below are notable for their unique approaches to some of the most visually disabling conditions in eye care.

|

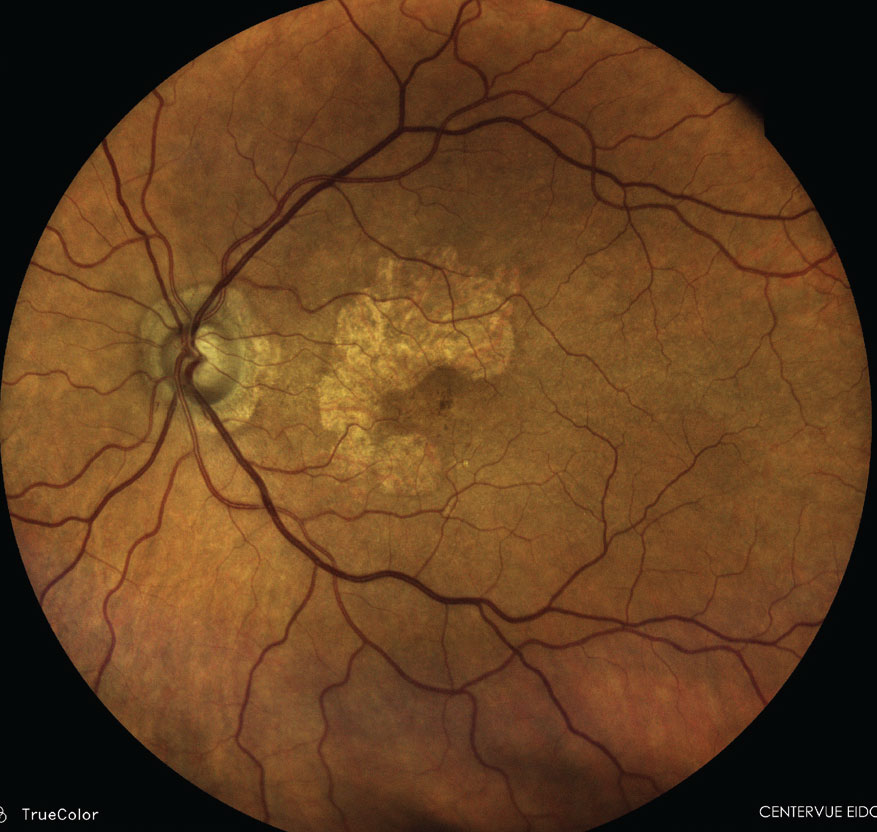

AMD, Diabetic Retinopathy and RVO

Although the eyecare community has had access to drugs to treat wet age-related macular degeneration (AMD) for nearly 20 years now, it was only last year that we finally saw the launch of not one but two drugs for a specific presentation of the dry form, that being geographic atrophy (GA). Even though the GA drugs do not deliver the visual improvement gains that anti-VEGF agents do in wet AMD, their release is historic and finally makes intervention here a viable option.

- Syfovre (pegcetacoplan injection 15mg), Apellis

- Status: FDA-approved February 2023 for treatment of GA secondary to AMD.

- Mechanism of action: Synthetic peptide-based inhibitor of C3. Acts on the central protein in the complement cascade to help regulate complement overaction.

- Clinical trial data: OAKS and DERBY; reduced GA lesion growth up to 36% (monthly injections) and increasing treatment benefit with time.

- SIG: Injections monthly or every other month.

- Side effects: Ocular discomfort (>5%), neovascular AMD, vitreous floaters, conjunctival hemorrhage, endophthalmitis, retinal detachment, retinal vasculitis, intraocular inflammation (0.24%).

- What’s exciting? The first FDA-approved GA treatment.

- Izervay (avacincaptad pegol intravitreal solution), Iveric Bio

- Status: FDA-approved August 2023 for treatment of GA secondary to AMD.

- Mechanism of action: RNA aptamer that binds to and inhibits complement protein C5.

- Clinical trial data: GATHER2: 14% mean reduction in GA growth.

- SIG: Injections monthly or every other month.

- Side effects: Conjunctival hemorrhage, increased IOP, blurred vision, CNV, neovascular AMD, endophthalmitis.

- What’s exciting? Bimonthly dosing after one year resulted in a 19% reduction of mean GA growth rate.

|

|

2023 was a historic year for AMD treatments with the first two drugs approved for GA. Photo: Paul M. Karpecki, OD. Click image to enlarge. |

We also saw in 2023 an update to one anti-VEGF mainstay that can now reduce the burden of treatment. By allowing for a longer interval between injections, patients may feel some time has been given back to them. As well, there was the expansion of another drug to be indicated for diabetic macular edema (DME) following retinal vein occlusion (RVO).

- Eylea HD (aflibercept 8mg), Regeneron Pharmaceuticals

- Status: FDA-approved August 2023 for treatment of AMD, DME, diabetic retinopathy (DR).

- Mechanism of action: Inhibits the activation of cognate VEGF receptors by binding VEGF-A and PIGF proteins.

- Clinical trial data: PULSAR and PHOTON: compared to Eylea 2mg, Eylea HD demonstrated noninferior and clinically significant vision gains at 48 weeks when compared with bimonthly 2mg treatment.

- SIG: 8mg monthly for three months, then 8mg every two to four months with either AMD or DME or two to three months for DR.

- Side effects: Cataract, conjunctival hemorrhage, increased IOP, vitreous floaters, vitreous detachment, corneal epithelial defect, retinal hemorrhage.

- What’s exciting? A higher dose of aflibercept allows less frequent injection with the same effect of stable vision.

- Vabysmo (faricimab), Genentech

- Status: FDA-approved October 2023 for treatment of macular edema following RVO. Previous approval February 2022 for wet AMD and DME.

- Mechanism of action: Dual inhibition of VEGF and angiopoietin-2.

- Clinical trial data: Post-hoc analyses from four Phase III studies indicate Vabysmo had dried retinal fluid faster and with fewer injections in both wet AMD and DME. More wet AMD patients displayed absence of retinal fluid at 12 weeks in a post-hoc analysis from the Phase III TENAYA and LUCERNE studies. DME patients had less blood vessel leakage in the macula at 16 weeks in a post-hoc analysis from the Phase III YOSEMITE and RHINE studies.

- SIG: 6mg dose injected intravitreally every four weeks.

- Side effects: The most common adverse reactions (≥5%) were cataract (15%) and conjunctival hemorrhage (8%).

- What’s exciting? Vabysmo now has three indications for retinal disease: macular edema related to DR and RVO, as well as wet AMD.

Finally, an intriguing alternative to intravitreal anti-VEGF is also being developed that, if successful, would provide an oral therapy to combat angiogenesis. In addition to the benefits this would afford patients in safety, comfort and convenience, such an approval might (in theory) also allow optometrists to directly manage angiogenic diseases for the first time, as no intravitreal injection would be needed for administration.

- APX-3330, Ocuphire Pharma

- Status: Phase IIb (ZETA-1).

- Mechanism of action: Inhibits reduction-oxidation effector factor-1 to block downstream pathways involved in angiogenesis and inflammation.

- What’s exciting? BID oral drug intended to help prevent development of proliferative diabetic disease or macular edema. Current trials are studying its use in nonproliferative DR, but it could also have uses in DME and AMD.

Takeaways

New drug development is continuously being undertaken within every eyecare specialty. Luckily for practitioners, we’re in a phase where many are making it to market after long periods of gestation. Especially at the moment, there’s no shortage of exciting new options to inform our patients about—and put to good use for their benefit.

Dr. Habibi is a UC Berkeley trained optometric doctor with a specialized focus on ocular surface disease and specialty contact lenses. She currently is the owner and fellowship director at Ojos Del Mar in Tamarindo, Costa Rica. She is an education consultant for Valley Contax.

Dr. Buboltz graduated from Illinois College of Optometry and completed residency at Minnesota Eye Consultants. He is the residency coordinator at Minnesota Eye Consultants, specializing in dry eye care, specialty contact lenses, anterior segment disease and glaucoma. His financial disclosures include Tarsus and Oyster Point (Viatris).

Dr. Lang is the medical director of dry eye services and residency director at Associated Eye Care, practicing full-scope optometry with expertise in dry eye disease, comprehensive optometry, therapeutic contact lenses and surgical comanagement. He is vice president of the Intrepid Eye Society and chief editor of Presbyopia Physician. A full list of his disclosures can be found here.

1. Kaiti R, Shyangbo R, Sharma IP. Role of atropine in the control of myopia progression- a review. Beyoglu Eye J. 2022;7(3):157-66. 2. Matsuo M, Matsuoka Y, Tanito M. Efficacy and patient tolerability of omidenepag isopropyl in the treatment of glaucoma and ocular hypertension. Clin Ophthalmol. 2022;16:1261-79. |