|

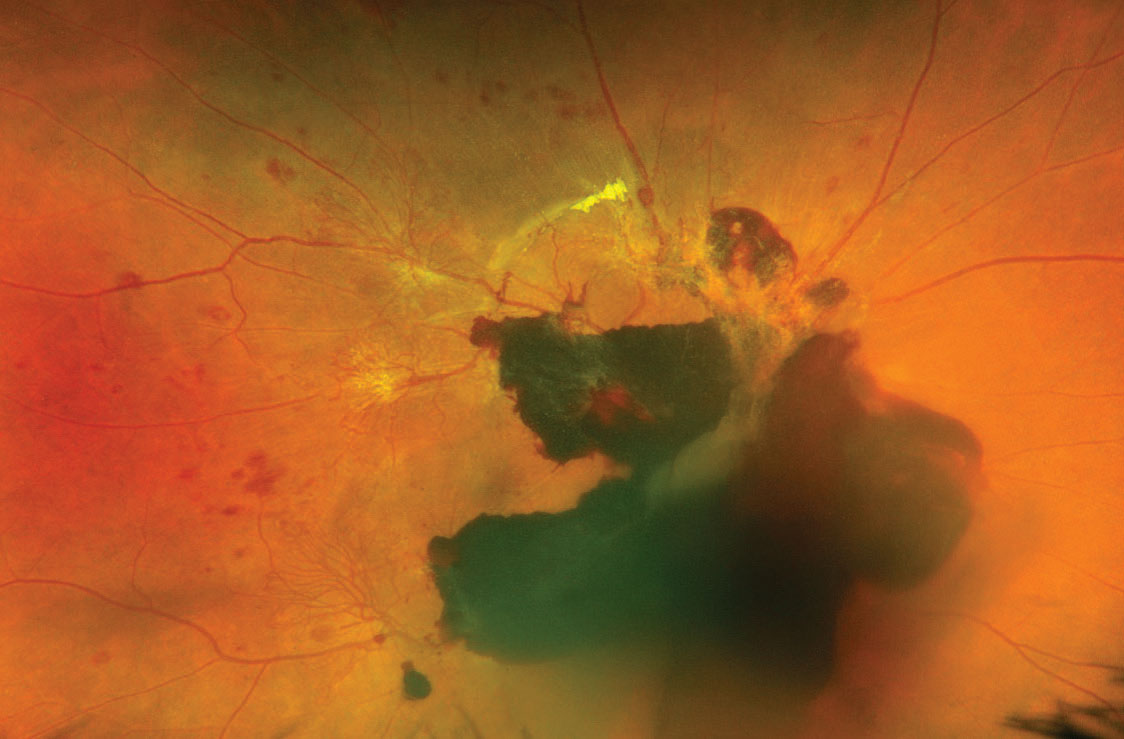

Researchers reported that vitreous hemorrhage was the most prevalent in uninsured PDR patients (35.1%) and the lowest in Medicaid patients (14.2%). Photo: Alison Bozung, OD. Click image to enlarge. |

It’s a truism of medicine that “an ounce of prevention is worth a pound of cure,” since it’s better for individual patients as well as the overall healthcare system if disease onset can be avoided or delayed. But physicians also understand that not everyone is covered by medical insurance, which reduces the amount of routine care provided and hence allows diseases to develop and progress more readily in those with inadequate coverage.

Although this relationship between insurance status and overall health is well-known, studies that shed light on this process are of value in directing efforts toward vulnerable populations. For instance, researchers from the University of Colorado have just published findings on how insurance affects the rate of diabetic retinopathy. Here is what they discovered.

Researchers analyzed the electronic health records of 313 patients with diabetic retinopathy (DR) from January 2014 to December 2020 provided by the Denver Health Medical Center. According to their data, a high proportion of non-English speaking patients were uninsured (63.9%). Focusing solely on uninsured, discount plan and Medicare/Medicaid patients, the researchers found that the rates of proliferative diabetic retinopathy were different amongst each plan: 62% for uninsured patients, 42% for those on discount plans and 33% in the Medicare/Medicaid population.1

Then, in analyzing the total median costs of different plans, they found a significant difference between discount plan patients and Medicare patients as well as discount plan patients and Medicaid patients. The median cost for discount patients was $1,258 (range = $0 to $5,901), median Medicare cost was $751 (range $0 to $7,148) and median Medicaid cost was $593 (range = $0 to $6,299).

In their paper on the study, the researchers mentioned that previous reports have suggested that the increased rate of DR is related to other complications and fewer eyecare visits, which would explain the higher prevalence in uninsured patients. “Additionally, the presence of proliferative diabetic retinopathy is greater in patients with a longer duration of diabetes, elevated HbA1c, high blood pressure and Hispanic race.2 We did not find significantly elevated HbA1c, duration of diabetes or prevalence of hypertension in the uninsured compared to the other insurance groups in the present study,” mentioned the researchers in their study.

Although this study explained how different insurance plans affect diabetic retinopathy, it did not take into account the higher socioeconomic status and ethnic diversity of different regions. Furthermore, costs for diabetic retinopathy screening and treatment were assessed over a 24-month period after acquiring data from the medical center. Since insurance costs fluctuate from time to time, the researchers believe a longer time period is warranted to sufficiently observe the differences in insurance costs.

“Efforts to promote equity in diabetic retinopathy care should focus on mitigating gaps in insurance coverage and barriers to preventative care in vulnerable communities in order to improve visual outcomes,” stated the researchers in their study.

1. Rajeswaren V, Lu V, Chen H, et al. Healthcare resource utilization and costs in an at-risk population with diabetic retinopathy. Translational Vision Science Technology. 2024;13(2):12. 2. Gange WS, Lopez J, Xu BY, et al. Incidence of proliferative diabetic retinopathy and other neo-vascular sequelae at 5 years following diagnosis of type 2 diabetes. Diabetes Care. 2021;44(11):2518–2526. |