What's Powering the Next Wave?In the September issue—our 45th annual technology report—find out how AI, telehealth, OCT and other new clinical devices are helping ODs build out their practice for the future. Check out the other featured articles here:

|

|

| Click to enlarge. |

Seasoned clinicians will tell you that the best tool they have for diagnostic assessment is their own brains, as years of exposure to thousands of clinical puzzles develops finely attuned instincts. But some technology used in optometric practice, most notably OCT, can be transformative, revealing the status of the eye in remarkable detail and opening up entirely new modes of care. OCT has emerged as an essential tool—and it tops the list of new medical equipment optometrists are planning to buy in the next year, according to a reader survey we conducted this summer.

Of course, not everything on someone’s wish list ultimately ends up in their shopping cart, however. Especially in a time of financial uncertainly, optometrists need to pick and choose carefully when investing in their practices. Which factors guide this process? We asked, and you answered. Here’s what your fellow ODs had to say.

|

| Click to enlarge. |

Invaluable Investing

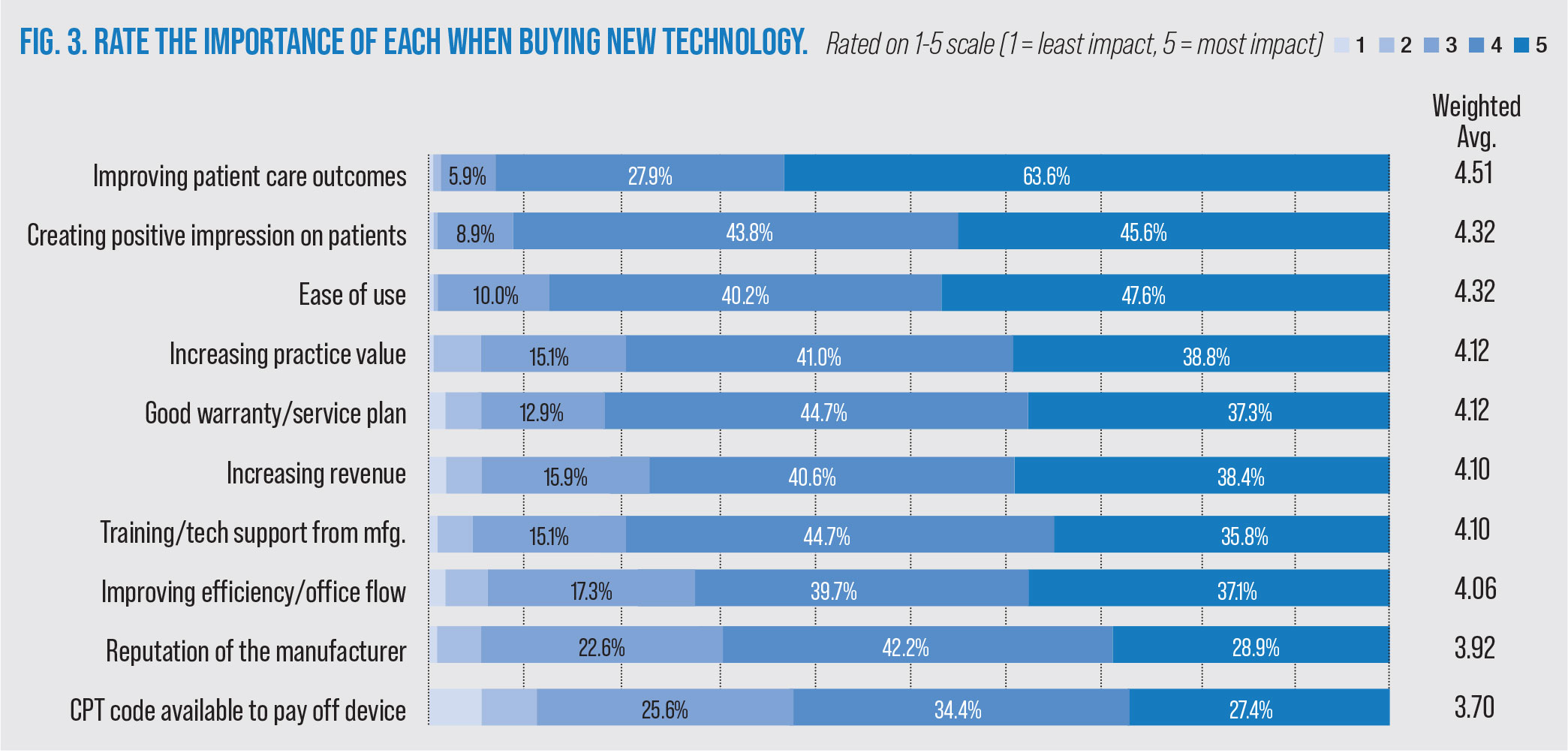

A total of 276 optometrists responded to our survey to keep us in the loop about the latest pieces of equipment they’ve invested in and those they have their eye on. This pool of ODs tends to focus on patient care, positive impressions and ease of use when deciding whether to upgrade technologies. Other priorities include adding practice value and revenue, as well as device warranty/service plan.

“Making patient contact easier and safer is a big priority,” emphasized one respondent. Another, Marc Ullman, OD, of Pine Beach, NJ, said that his patients appreciate seeing new equipment at his practice and associate these additions with meaningful progress. Along the same lines, Stephen DuBois, OD, of Jacksonville, FL, noted, “We always look for things that can either add patients to the practice or give existing ones something to talk about.”

|

| Click to enlarge. |

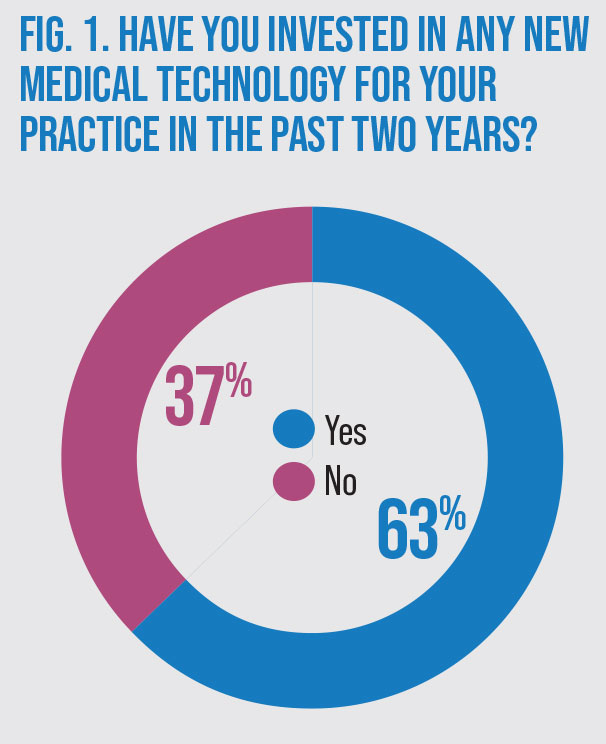

Keeping their priorities in mind, 63% of respondents took the leap and found it worth making new additions to their clinics over the past two years (Figure 1), most commonly including imaging devices such as Optos, OCT and fundus cameras. “Seeing is believing,” said survey respondent Duke B. Yoon, OD, of Lakewood, WA, to emphasize the importance of visual data in patient enthusiasm and compliance. “When patients see their retinal artery and vein, or some hemorrhage in the retina, they are excited about the importance of eye care and very enthusiastic” about taking action to protect their vision, he says.

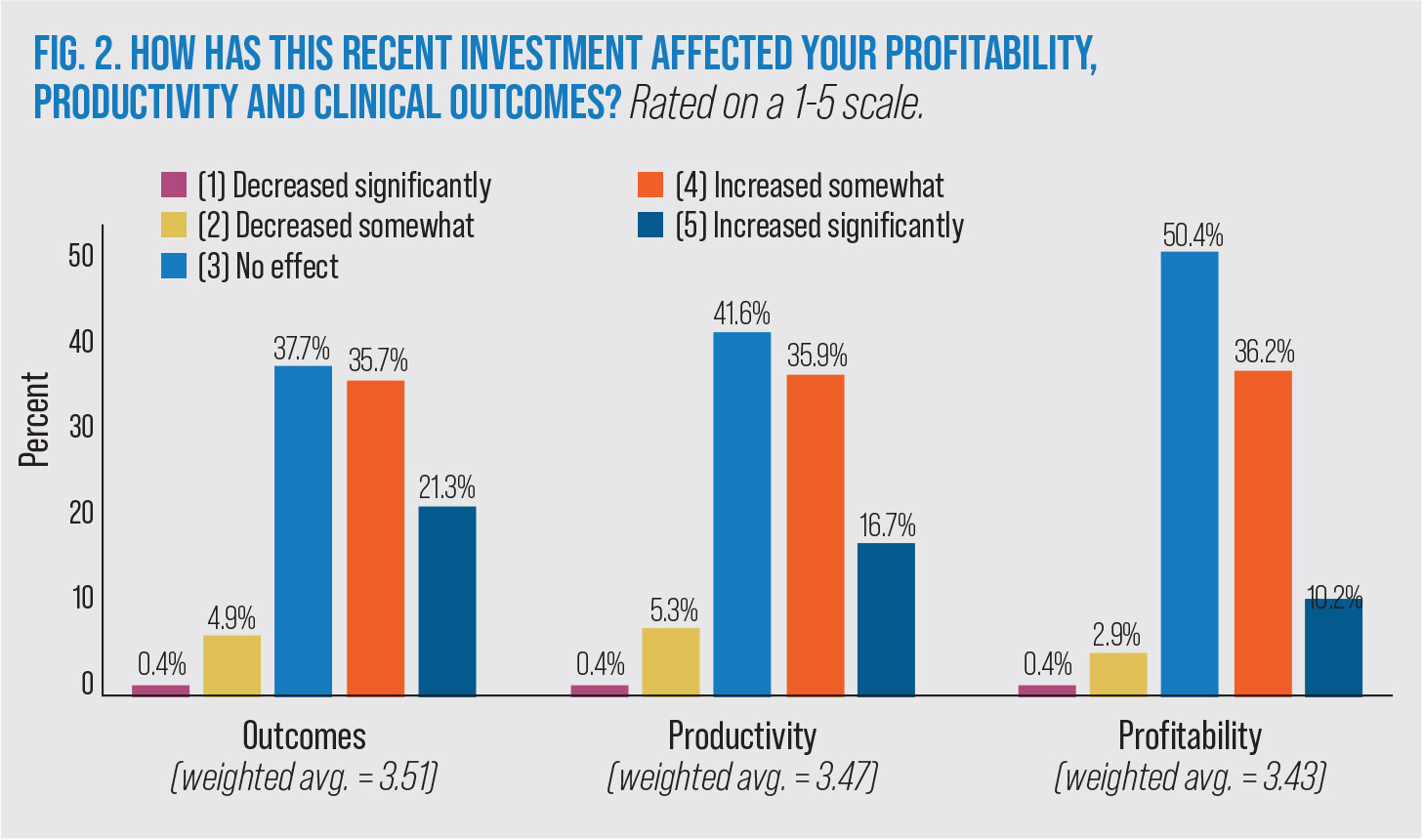

What motivates an OD to invest? The big three goals are typically to improve patient care, streamline office flow and boost practice revenue. We asked readers to rate their most recent purchase in these areas to see if the new tech delivered. It was a decidedly mixed bag. As far as achieving the intended effect, 57%, 53% and 46% of respondents, respectively, noted an increase in clinical outcomes, productivity and profitability (Figure 2). The rest, for the most part, claimed to have seen no effect or even small decreases in each of these measures.

|

| Click to enlarge. |

For each of these three factors, the weighted average—a composite score that encapsulates all responses—showed the sentiment to fall squarely between “no effect” and “increased somewhat,” although better clinical outcomes did edge out the other two.

Improving clinical outcomes also topped the list when we asked for ratings of several aspects of the purchasing decision (Figure 3). Here, the weighted average score of 4.51 shows optometrists’ strong commitment to buying equipment with their patients in mind. Tied for second in the rankings were the goals of creating a positive impression on patients and the device’s ease of use. Somewhat surprisingly, reputation of the manufacturer and availability of a CPT code—two elements often touted in product marketing—ranked the lowest in ODs’ priorities.

Several readers pointed out that challenges in hiring and retaining good staff affects equipment purchases, too. “I’m always looking to increase efficiency with equipment,” wrote one OD from South Bend, IN. “Staffing is getting more difficult and more expensive, so I’m looking to efficiencies with technology and equipment to do more with the same or less staff.”

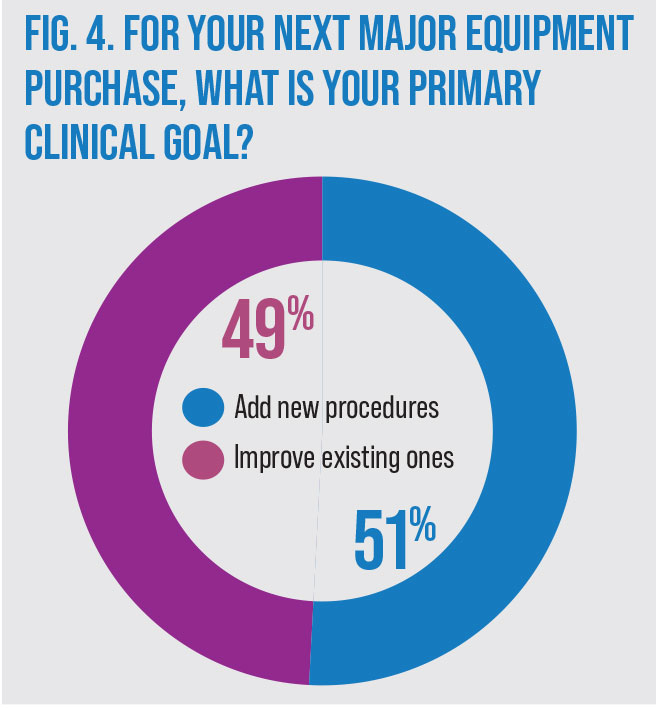

With patient care the guiding principle for new equipment purchases, what specifically does that entail? Given the array of procedures that fall under the umbrella of primary eye care, an optometrist has no shortage of options to pursue. Interestingly, almost as many ODs in our survey reported that they invest to improve existing procedures and services as they do to add new ones (Figure 4).

|

| Click to enlarge. |

To Have and Have Not

With some clinics “all in” on new advancements and others just starting to revamp their office space, it’s worth noting that not every piece of technology holds the same clinical utility, requiring ODs to weigh each tool’s benefits against their budget.

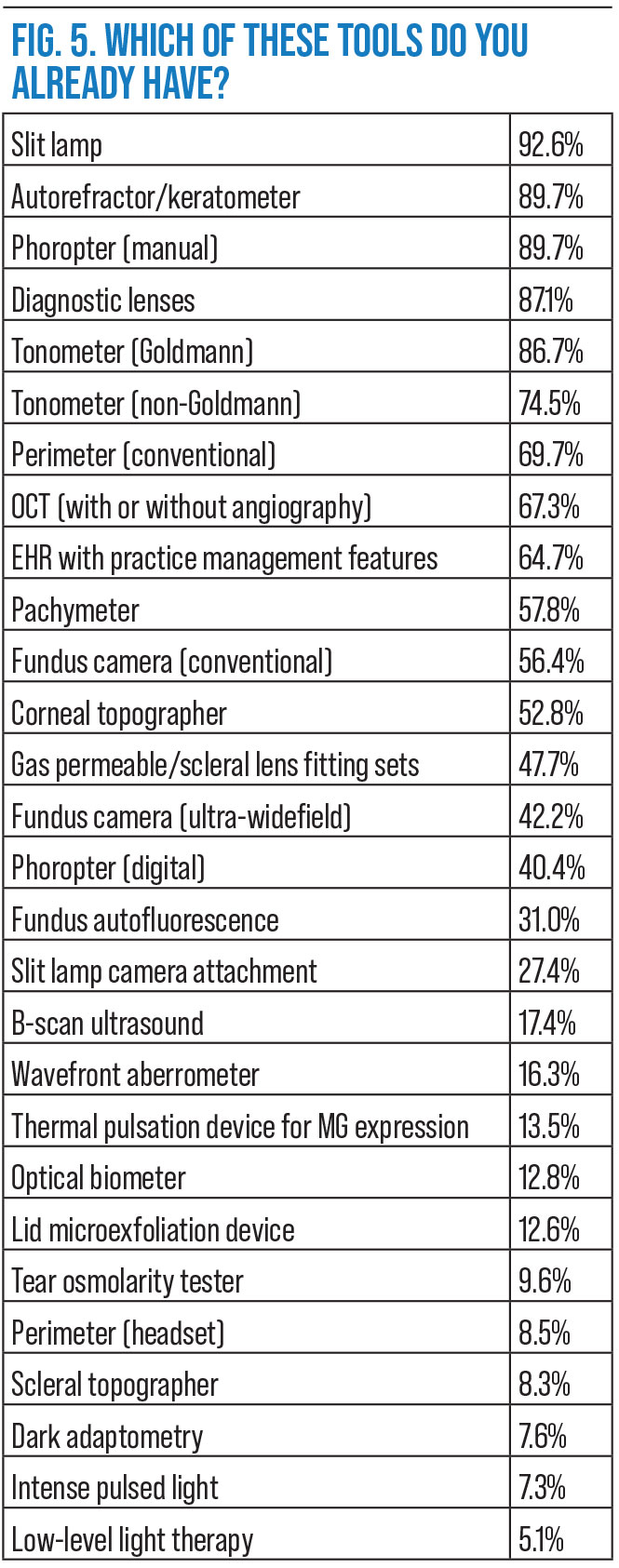

Most respondents already own the standard battery of primary eyecare equipment. Nine out of 10 ODs have the essential trio of slit lamp, manual phoropter and autoref/keratometer (Figure 5). More specialized tools like scleral topographers and advanced dry eye treatments (IPL and LLLT) have some of the lowest penetration rates to date, though interest in the dry eye tech is high for the near future. Dark adaptometry, however, has yet to find an audience, a proposition complicated by the recent exit of Maculogix from the market.

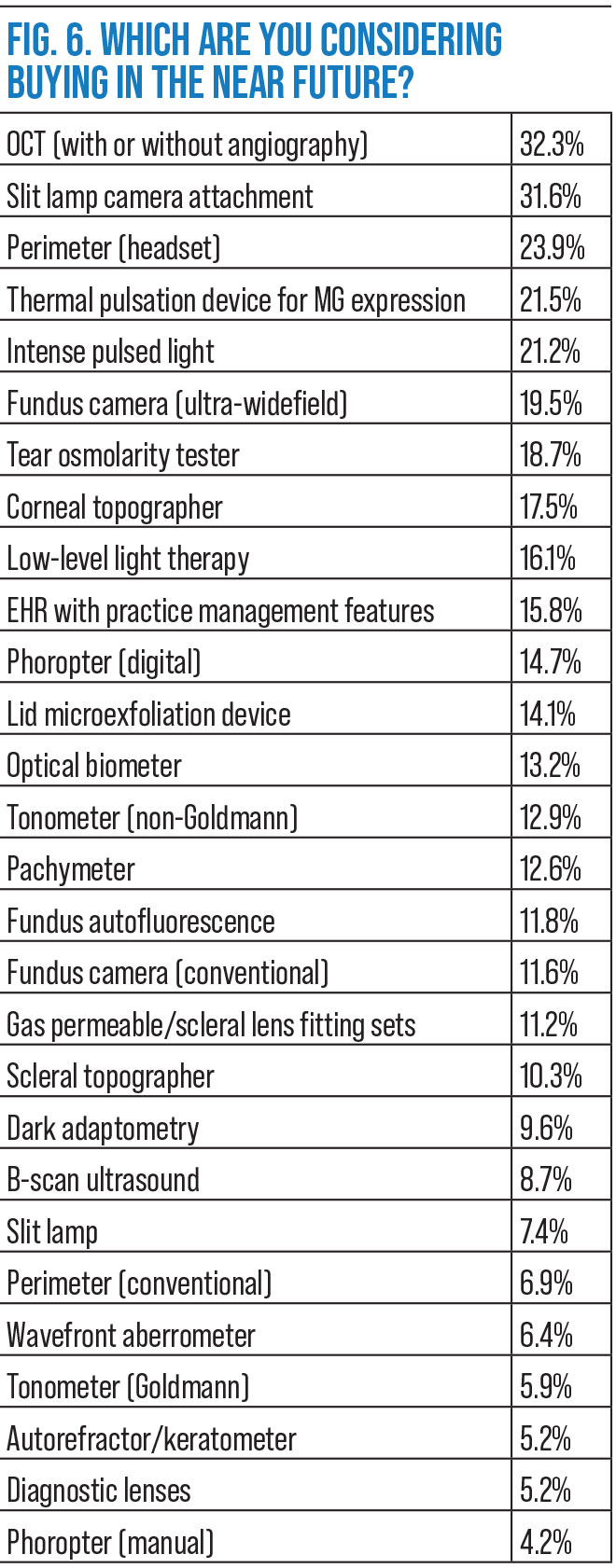

Turning to wish-list items (Figure 6), OCT already has a healthy adoption among our readers—two-thirds have such a device—and getting on board with it is the number one goal for those who don’t. Of the 32.2% of readers in the market for OCT right now, there’s a lack of consensus on whether or not devices with angiography capabilities are worth it for them. It’s split pretty evenly, with 16.9% of respondents looking to add OCT-A and another 15.4% opting for the standard OCT models.

Either way, it’s a win for them and their patients. Milwaukee’s Robert Blankenbehler, OD, raved about his recent OCT purchase. “It is a versatile instrument used at least 10 times a day,” he wrote.

|

| Click to enlarge. |

“I think the more ‘combination’ machines are the best—for example, the OCT can do anterior segment scans and give me a pachymetry reading without having to use a handheld pachymeter,” a reader from Detroit offered. “I hope technologically we move towards more combination feature machines for convenience for the patient and doctors alike. It would also remove the burden of time during patient flow.”

Also posting strong numbers for intent to purchase were slit lamp camera attachments—ideal for patient education and pathology documentation—and the new virtual reality perimetry headsets that move visual field testing beyond traditional SAP.

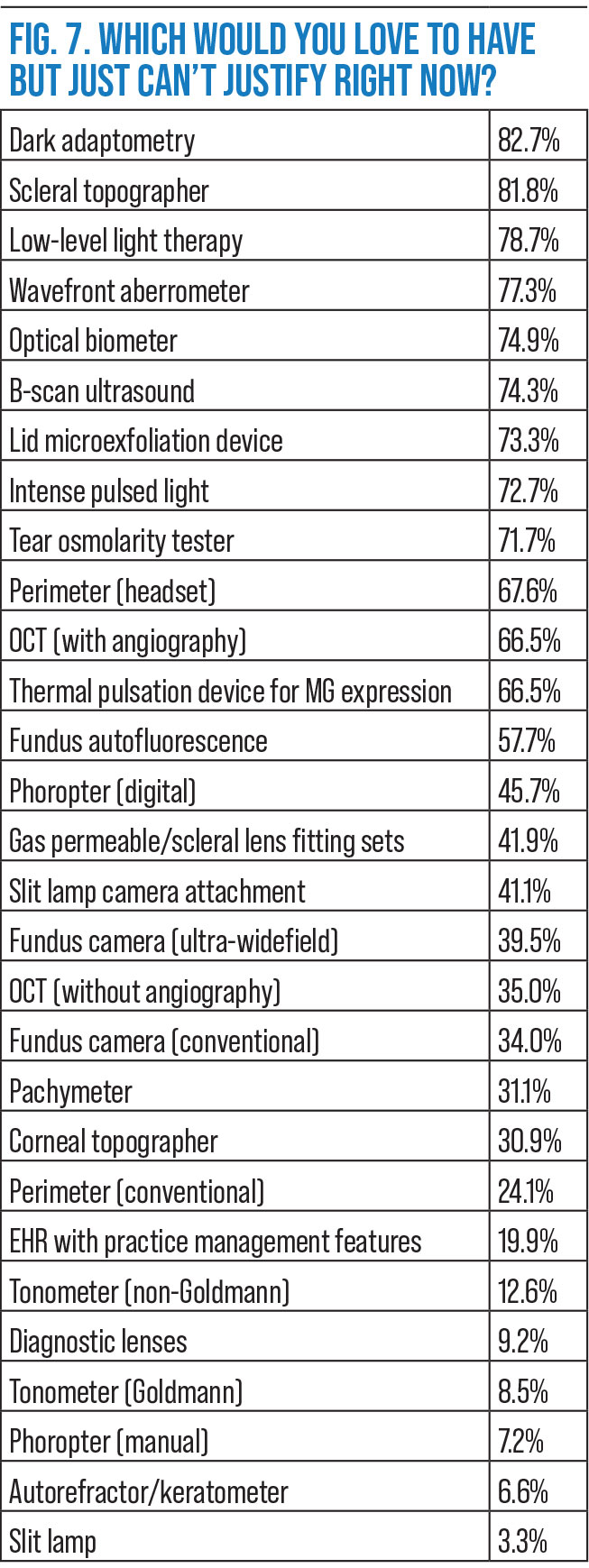

With so many products, naturally there are plenty that ODs just can’t justify even if they do seem cool (Figure 7). Items at the top of that list are too niche for many ODs; products at the bottom more often than not are workhorse devices that rarely need an upgrade.

Many respondents said return on investment, office space and equipment cost are what’s holding them back. Others noted that comanagement allows them to take advantage of other colleagues’ services—and invest in relationships rather than equipment—while also offering their own.

One highlighted the mistake of taking existing tools for granted. “I can buy it, but integration of a product is what scares me most. I don’t want to add too much and not be able to use the devices. If I spread myself too thin, I won’t be doing anyone any favors, especially my patients. If I focus on what I have and can improve upon it, I would consider adding more.”

|

| Click to enlarge. |

Selling Themselves Short

Sales reps strongly influence the opinions optometrists have about the company and whether or not to do business with them. The impression we got from our readers? Well, maybe reps should cut back on their caffeine intake a bit.

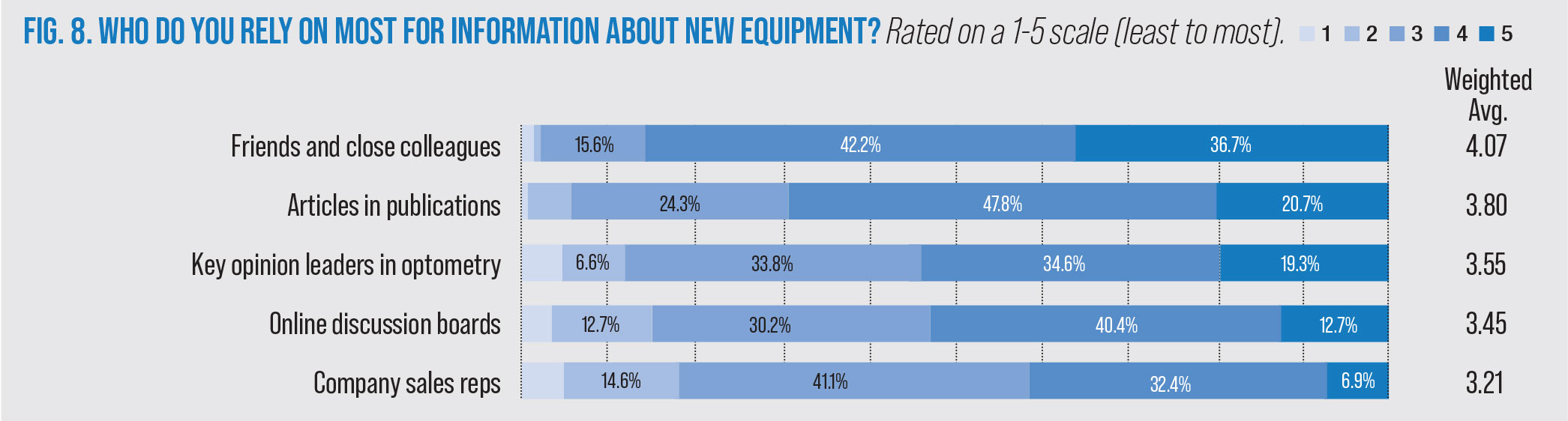

“I dislike pushy sales people,” said Samantha Love, OD, of Clermont, FL. “I value feedback from my fellow colleagues about their experience with the device.”

A reader from Southern California agreed. “The product should sell itself, with testimonials from other professionals who have used it. Reps should be able to feel safe to give references to practices with recent purchase.” This doctor also said they wish sales reps would understand the differences between small vs. large practices, optometry vs. ophthalmology and other distinctions that affect buying priorities.

Hard-sell tactics backfire, readers told us. “I hate when reps use a short deadline,” said an OD from Wisconsin. “I received a quote yesterday threatening that it’s only good for six days, then the price will most definitely increase.”

Sales reps who are too aggressive run the risk of alienating potential customers. “I might be a little too cautious when I approach the purchase of new equipment. I don’t enjoy sales reps who brush me off when they find out I financially cannot afford their device at the moment. I still want to learn everything about it even if I am not in the market to purchase at this time,” an OD from Utah commented. “In my situation, it would be beneficial to have more opportunities to interact with the technology through presentations or seminars without the hard sales push.”

|

| Click to enlarge. |

Another reader noted that they wished manufacturers would post their equipment prices online, “rather than saying ‘contact us for price.’ When I’m researching equipment, I don’t want to deal with a rep initially.”

Instead, most optometrists in our survey prefer relying on friends and colleagues for advice about new purchases, followed by published articles, optometric opinion leaders, online discussion boards and, least of all, company sales reps (Figure 8).

|

| Click to enlarge. |

Health Care on the Horizon

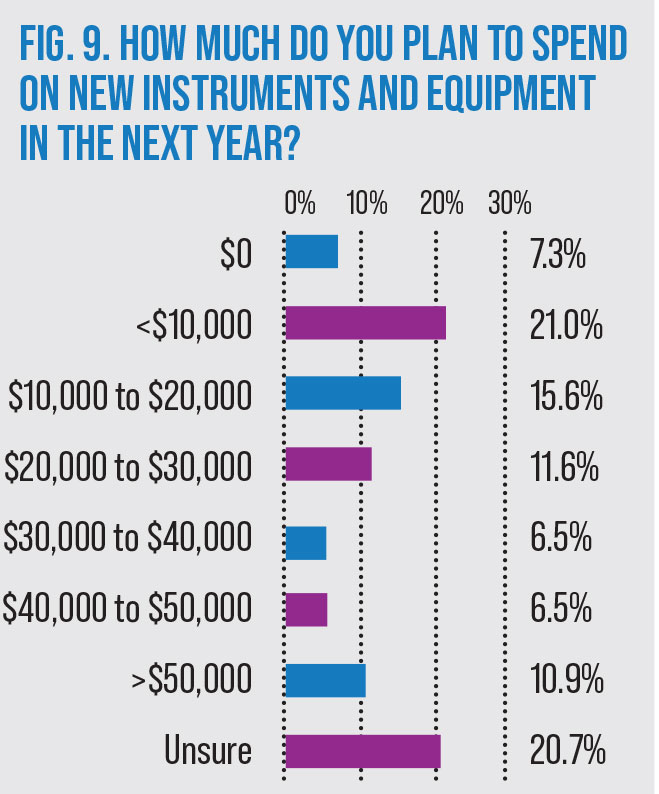

Looking to future purchases, the more expensive the investment, the more hesitant ODs are to commit (Figure 9). The sweet spot in spending came out to be $10,000 or less (21%), with 7% of ODs completely against looking into purchasing any dollar amount of equipment in the next year and another 21% unsure. Joette Wisoky, OD, of Lexington, KY, commented that they’re not looking to buy the most expensive option on the market; rather, the most practical tool that aims to benefit the most patients is what catches their eye.

“Purchasing equipment is the easy part,” remarked respondent Larry Macapagal, OD, of Los Angeles. The hard part is what comes next: training, maintenance, upgrade and replacement. But it’s worth it, with one survey respondent going so far as to say it’s part of the OD’s job to keep adding to their armamentarium. “Many factors go into device purchasing, but the most important is providing the highest quality care to patients. Being in the healthcare field requires staying up to date on everything including technology; we would be doing patients a disservice if we never updated.”